On August 29, 2025, the US government suspended the de minimis exemption for goods imported from all countries. Previously, this exemption allowed international shipments valued under $800 to enter the US duty-free with simplified customs processing.

This change is likely to impact online shoppers and small US businesses sourcing supplies from overseas. The US processes around four million de minimis packages per day.

As of August 29, virtually all shipments entering the United States are now subject to duties and require a customs entry.

At the time of writing, many national postal services like Deutsche Post and Royal Mail are pausing shipments to the US due to regulatory uncertainty. According to NPR, they need to figure out how to handle new paperwork for millions of packages and how to collect money for duties and taxes.

Merchants from many countries will continue to ship documents, which are still exempt, and export via express services.

In this post, we’ll explain what tariffs are and how they impact global commerce. Then, we’ll provide an overview of the recent changes and how both US and non-US ecommerce businesses can adapt and move forward.

Tariffs are import taxes that increase the cost of foreign goods relative to domestic alternatives. These taxes are paid by the importing party (either the business or consumer), and the resulting funds are passed to the importing country’s department of finance — in this case, the US Treasury.

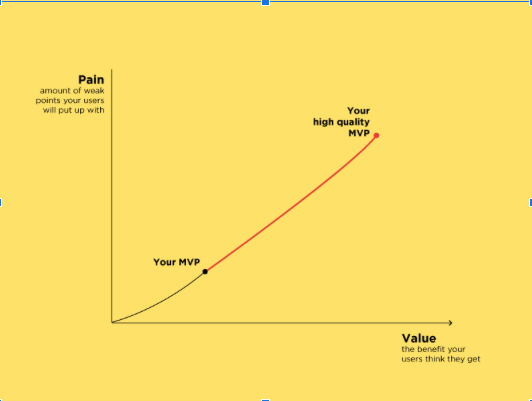

For US merchants, import tariffs can sometimes provide a competitive advantage — they increase the cost of international competitors’ goods while leaving the cost of domestically produced goods unchanged.

On the other hand, both international businesses that sell to US customers and small US businesses that import products from outside the US for resale will face increased difficulties.

When US customers buy from an international merchant shipping to the US, the total cost now includes newly applied duties and customs processing fees, leading to higher prices and potential delays.

When customers buy from domestic businesses, they can receive a similar product with faster shipping, no import fees, and simplified returns.

Duties vs. Taxes — what’s the difference?

Duties: These are fees imposed specifically on imported goods, often based on the product’s classification and value.

Taxes: These include broader taxes such as the Value Added Tax (VAT) or Goods and Services Tax (GST), which apply to both imported and domestically produced goods. Tariffs and duties are both considered indirect taxes.

Before

- The exception allowed international shipments valued under $800 to enter the US duty-free and with simplified customs processing. A 10-digit HTS code was recommended but not mandatory. Fast delivery and customs times allowed international merchants to compete with domestic US fulfillment.

- All US shipments above the de minimis threshold required customs documentation, including 10-digit HTS classification codes.

After

- All shipments to the US now require a customs entry and are subject to duties and taxes. Shipments above $2,500 require formal customs entry, while shipments below require an informal entry. The informal entry is significantly more complex than the previous de minimis process.

- A 10-digit HTS code is now required for all non-postal shipments (e.g., via couriers like UPS) to calculate duties. For postal shipments, accurate country of origin and item value are the primary data points required.

- Carriers and logistics partners must now post a customs bond to cover duty payments for low-value shipments. Merchants should ensure their shipping partners are fully compliant with these new bonding rules to avoid shipment holds.

- Duties now vary based on the country of origin and the items being imported. According to ShipStation, courier shipments will face full duties and tariffs and postal shipments will be assessed by either:

- Ad valorem duty: A percentage based on the country of origin tariff rate (IEEPA).

- Specific duty: A flat rate between $80 and $200 per item, depending on the country’s tariff.

- Major national carriers like Deutsche Post and Royal Mail have suspended services due to regulatory uncertainty.

- Private carriers, including UPS and DHL Express, are continuing normal operations. While their shipments are also subject to new duties, they have robust systems in place to manage customs clearance.

- Longer customs processing times are expected, potentially causing delayed deliveries.

- Shipments of personal gifts valued at less than $100 and personal travel exemptions still remain, including $200 in personal items.

What the new tariffs mean for global ecommerce

The end of the de minimis exemption introduces new duties, customs requirements, and shipping complexity for international sellers shipping into the US. This shift may reduce the volume of low-value international shipments, at least temporarily, creating changes in the competitive landscape.

This change was applied to imports from China and Hong Kong in May of 2025, which resulted in a 43% decrease in low-value ecommerce shipments from China to the US, as reported by Reuters.

For US businesses: Opportunities and drawbacks of eliminating the de minimis exemption

For US merchants, this could mean less competition